Bank Statement Importer

Automatic entry and reconciliation of bank payments

Reduce your bookkeeping work by up to 90%

What are the benefits of automatic import of bank payments?

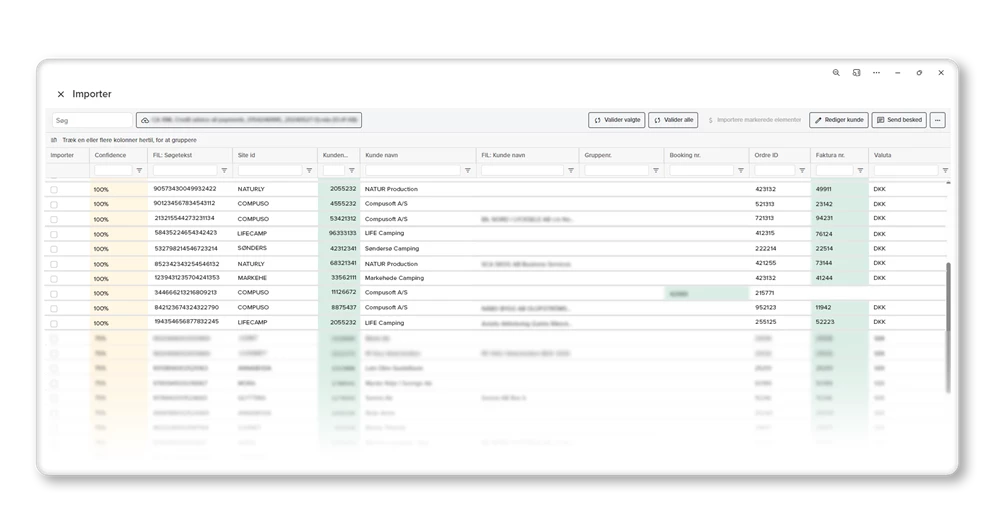

When a CSV file is imported from your bank to your booking and administration system, the system analyses the bank file for date, name and amount. All transactions are then verified and checked so that you are protected against errors and differences.

You gain the following benefits:

- Automatic entry of bank payments directly to the customer’s accounts in your booking system

- Automatic verification and control of bank payments

- Automatic posting of bank payments

- No typos

- Reducing the time you spend on bookkeeping work.

How does it work?

A digital invoice or charge is sent to the customer, where a payment ID is generated. When the customer pays through their bank, they enter the payment ID when making the payment.

During the import process, the payments are analysed and the system matches them with your invoices in the booking and administration system using the payment ID. This automatically posts the payment to the right customer and invoice or booking.

The system also checks for double payments, incorrect payments and whether the amount paid matches the invoice amount.

Even if the payment ID, customer number, booking number or other information is entered incorrectly, the intelligent system searches all parameters to match the payment correctly.

Order the module here

arrow_forwardAutomatic verification of payments

During the process of loading the file from your bank into your system, the system analyses all transactions and data. This initiates an automatic control calculation and verification of the payments.

The system matches the payment ID and the payment with the underlying system, after which you are presented with a preview of the analysis result. This will indicate if there are any discrepancies or transactions you should follow up on.

Once you have approved the analysis, the automatic process continues and the payments are posted to the correct customer and the correct account.

Thus, you are always guaranteed error-free accounting of bank payments.

Automatic analysis tool for multi-business, bank integration and foreign currency support

With our automatic import of bank payments, you can easily handle multiple businesses, multiple bank accounts and multiple currencies.

For example, you can create separate bank accounts for your foreign customers that support the currencies you receive. This will often result in significant savings on the banks’ exchange fees.

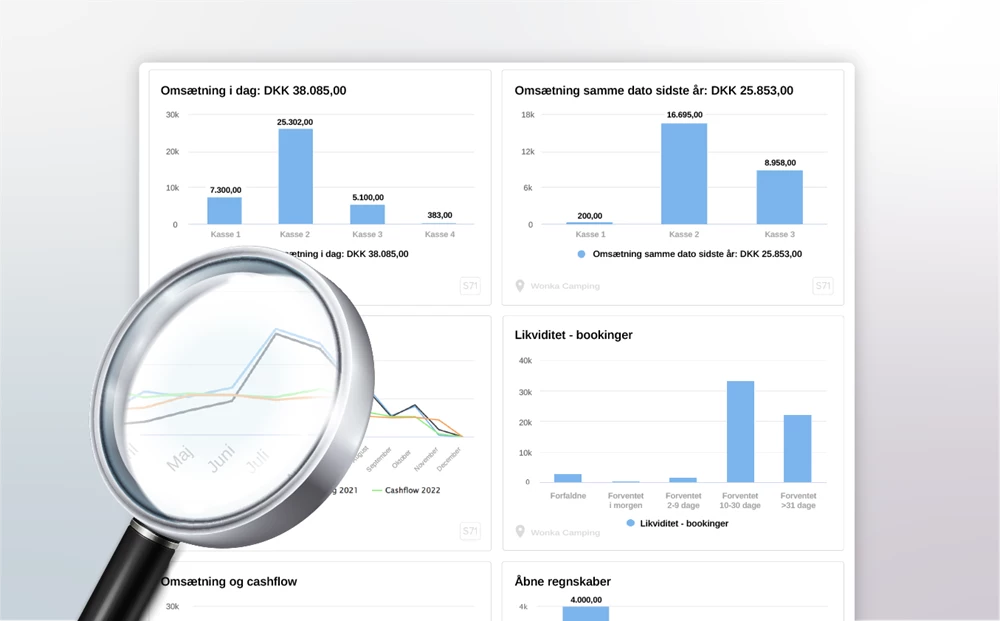

With the system’s DashBoards, you have a complete overview, with payments, cash flow and debtors clearly broken down per business with all the details you need.

Optimise your bookkeeping even further with our Finance integration

Another module that can really streamline your bookkeeping work is our finance integration for financial systems.

With this integration, you gain even more benefits. You avoid the manual accounting procedure of all your income in your financial system.

The financial integration module handles the posting of all your transactions entered in your CompuSoft products directly to the correct financial accounts in your financial system.

Combine the finance integration module with automatic entry of bank payments and free up time from bookkeeping.